Outokumpu Oyj's Dividend Analysis

Assessing the Sustainability of Outokumpu Oyj's Upcoming Dividend

Outokumpu Oyj (OUTFF) recently announced a dividend of $0.26 per share, payable on 2024-04-15, with the ex-dividend date set for 2024-04-05. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Outokumpu Oyj's dividend performance and assess its sustainability.

What Does Outokumpu Oyj Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

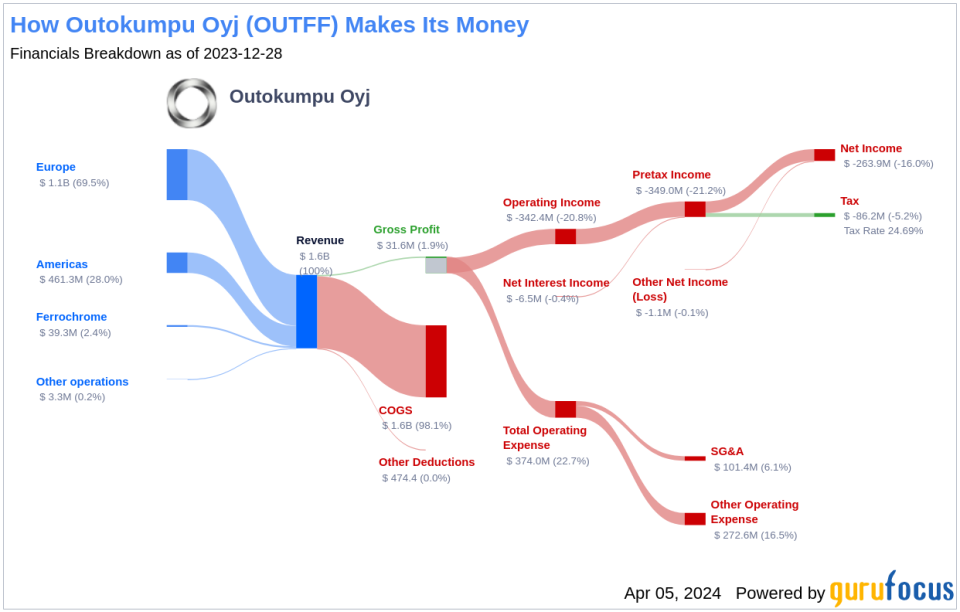

Outokumpu Oyj is a global leader in the stainless steel industry, with operations spanning across Europe, the Americas, and Ferrochrome production. The company specializes in high-volume and tailored standard stainless steel grades, which find applications in various sectors including architecture, transportation, and energy. Outokumpu Oyj's Americas division focuses on standard and tailored stainless steel products, while its Ferrochrome division is dedicated to producing charge grade ferrochrome, an essential ingredient for stainless steel.

A Glimpse at Outokumpu Oyj's Dividend History

Outokumpu Oyj has established a stable record of dividend payments, beginning in 2022, with distributions occurring annually. Investors can monitor the company's commitment to returning value through the historical Dividends Per Share data.

Breaking Down Outokumpu Oyj's Dividend Yield and Growth

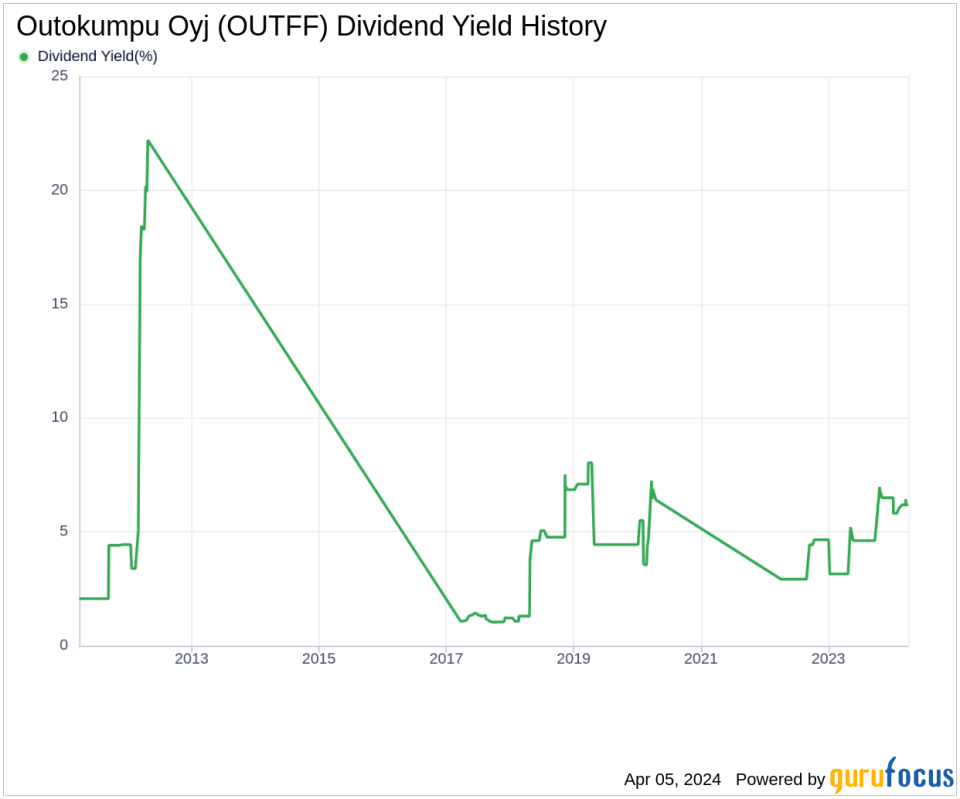

As of today, Outokumpu Oyj boasts a 12-month trailing dividend yield of 6.30% and a forward dividend yield of 6.47%. This forward-looking metric indicates a potential increase in dividend payments over the next year. Additionally, the 5-year yield on cost for Outokumpu Oyj stock is approximately 6.30%, reflecting the yield an investor would receive if the stock was purchased five years ago.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is a critical metric in assessing dividend sustainability. A lower ratio is generally preferred as it implies that the company retains more earnings for growth and to cushion against downturns. Outokumpu Oyj's payout ratio stands at 0.00 as of 2023-12-31, indicating no payout or a possible lack of earnings to cover the dividend. The company's profitability rank of 4 out of 10 also suggests challenges in sustaining dividends, despite having reported net profit in six of the last ten years.

Growth Metrics: The Future Outlook

For dividend sustainability, robust growth metrics are essential. Outokumpu Oyj's growth rank of 4 out of 10 raises concerns about its growth prospects, which could impact future dividends. Despite this, the company's revenue model seems resilient, with a revenue per share and a 3-year revenue growth rate that has increased by approximately 0.60% per year on average. However, this growth rate lags behind 80.31% of global competitors.

Concluding Insights on Outokumpu Oyj's Dividends

In conclusion, while Outokumpu Oyj's dividend yield is attractive, the sustainability of its dividends is questionable given its low profitability and growth ranks, and the absence of a clear payout ratio. Investors should carefully consider these factors when evaluating Outokumpu Oyj as a potential dividend investment. For those seeking high-dividend yield opportunities, GuruFocus Premium offers a High Dividend Yield Screener to discover stocks with strong dividend profiles.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.