Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

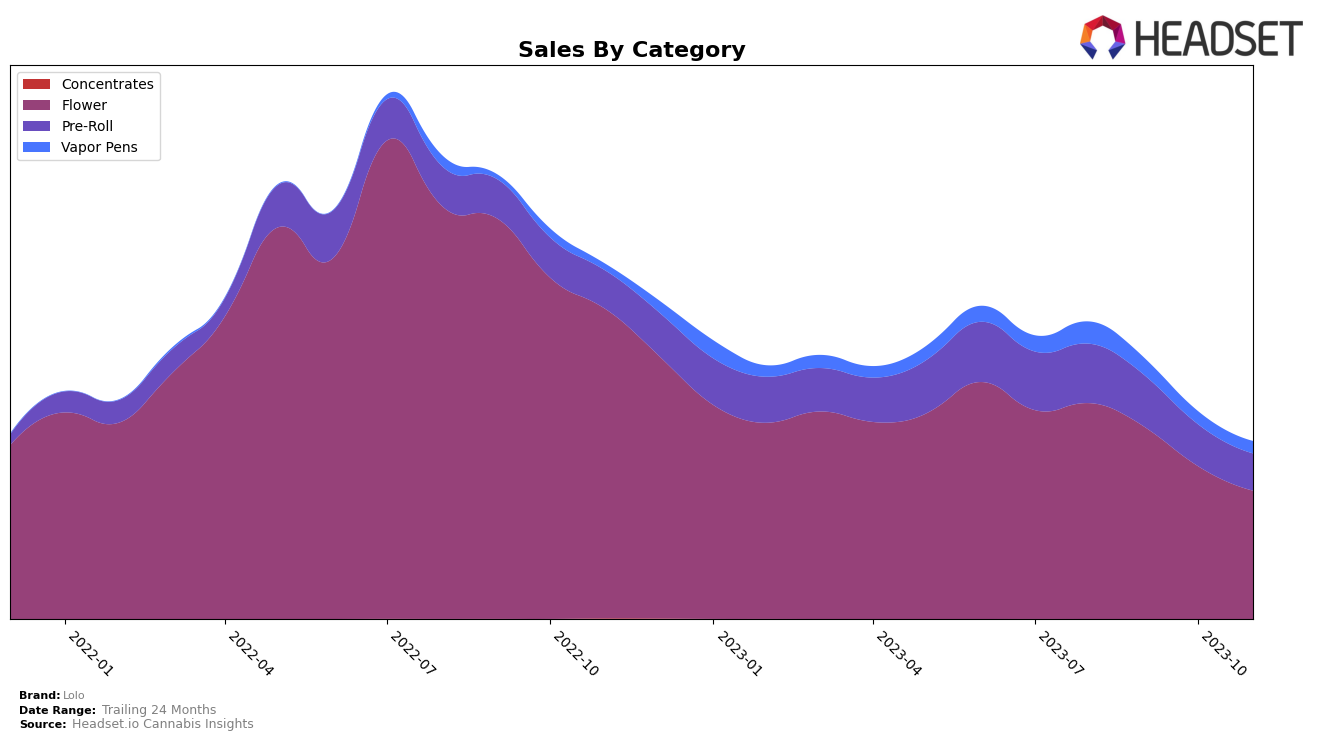

In the California market, Lolo has been experiencing a steady decline in its category rankings from August to November 2023. In the Flower category, Lolo dropped from the 10th position in August to the 17th position in November, indicating a decrease in its popularity among the top 20 brands in this category. This downward trend is also reflected in the brand's sales, which decreased from approximately 2.4 million in August to approximately 1.4 million in November. This trend suggests a need for the brand to reevaluate its strategies within the Flower category in California.

Lolo's performance in the other categories in California is also worth noting. In the Pre-Roll category, Lolo was not even in the top 20 brands in November 2023, as it ranked 32nd. This is a significant drop from its 21st position in August 2023. Similarly, in the Vapor Pens category, Lolo's ranking has also been dropping consistently, reaching 77th position in November from 61st in August. This indicates that Lolo's products in these categories are not as competitive as they once were in the California market. However, despite these downward trends, Lolo still maintains a presence in the market, suggesting potential for improvement with the right strategies.

Competitive Landscape

In the California Flower category, Lolo has experienced a slight decline in rank over the months from August to November 2023, moving from the 10th position to the 17th. This suggests a decrease in sales, as the brand has been outperformed by competitors such as THC Design, A Golden State, Yada Yada, and Allswell. It's worth noting that while THC Design and A Golden State have also seen a drop in their rankings, they still managed to rank higher than Lolo in November. On the other hand, Yada Yada and Allswell have shown an upward trend, with Allswell making a significant jump from the 29th position to the 18th. This indicates that these brands have been able to maintain or increase their sales while Lolo has been struggling to keep up.

Notable Products

In November 2023, the top-performing product from Lolo was the 'Deez Runtz Pre-Roll (1g)' with impressive sales of 7833 units. Following closely behind in second place was the 'PB & Jealousy Pre-Roll (1g)', maintaining its rank from the previous month with sales of 7432 units. The 'Cherry Iceez Pre-Roll (1g)' ranked third, while the 'Zest of Lemon Pre-Roll (1g)' and the 'Permanent Gelatti Pre-Roll (1g)' rounded out the top five. It's noteworthy that all top five products were from the Pre-Roll category. Compared to the previous months, November saw a significant shift in rankings with 'Deez Runtz Pre-Roll (1g)' emerging as a new leader.

Top Selling Cannabis Brands